The Automatic Millionaire

Making your money work for you ... automaticallyIn The Automatic Millionaire David Bach unlocks the secret to getting rich. Cutting through the jargon, it's full of common-sense advice and practical strategies to help you take control of your finances. The step-by-step guide and no-budget, no-discipline, no-nonsense system makes reaching financial security amazingly simple and easy, no matter what your income. You can get rid of the debt that's holding you down. You can get on top of your day-to-day expenses. You can create a safety net that will protect you from life's unknowns. You can have the money to get the things you want. You can build a seven-figure nest egg that will keep you secure and comfortable for the rest of your life.This book has the power to secure your financial future and change your life. All you have to do is follow the one-step programme - the rest is automatic!

See all

The Total Money Makeover

New York Times bestseller! More than Five million copies sold!You CAN take control of your money. Build up your money muscles with America's favorite finance coach.Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There's one sure way to whip your finances into shape, and that's with The Total Money Makeover: Classic Edition.By now, you've heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you're tired of the lies and sick of the false promises, take a look at this--it's the simplest, most straightforward game plan for completely making over your money habits. And it's based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you'll be able to: Design a sure-fire plan for paying off all debt--meaning cars, houses, everythingRecognize the 10 most dangerous money myths (these will kill you)Secure a big, fat nest egg for emergencies and retirement!Includes new, expanded "Dave Rants" sidebars tackle marriage conflict, college debt, and more. All-new forms and back-of-the-book resources to make Total Money Makeover a reality.Dive deeper into Dave's game plan with The Total Money Makeover Workbook: Classic Edition. The Total Money Makeover: Classic Edition is also available in Spanish, transformación total de su dinero.

See all

Think and Grow Rich

Think and Grow Rich - Napoleon Hill - The most famous of all teachers of success spent "a fortune and the better part of a lifetime of effort" to produce the "Law of Success" philosophy that forms the basis of his books and that is so powerfully summarized and explained for the general public in this book. In Think and Grow Rich, Hill draws on stories of Andrew Carnegie, Thomas Edison, Henry Ford, and other millionaires of his generation to illustrate his principles. This book will teach you the secrets that could bring you a fortune. It will show you not only what to do but how to do it. Once you learn and apply the simple, basic techniques revealed here, you will have mastered the secret of true and lasting success. Money and material things are essential for freedom of body and mind, but there are some who will feel that the greatest of all riches can be evaluated only in terms of lasting friendships, loving family relationships, understanding between business associates, and introspective harmony which brings one true peace of mind! All who read, understand, and apply this philosophy will be better prepared to attract and enjoy these spiritual values.

See all

The Millionaire Fastlane

10TH ANNIVERSARY EDITIONIs the financial plan of mediocrity -- a dream-stealing, soul-sucking dogma known as "The Slowlane" your plan for creating wealth? You know how it goes; it sounds a lil something like this:"Go to school, get a good job, save 10% of your paycheck, buy a used car, cancel the movie channels, quit drinking expensive Starbucks mocha lattes, save and penny-pinch your life away, trust your life-savings to the stock market, and one day, when you are oh, say, 65 years old, you can retire rich."The mainstream financial gurus have sold you blindly down the river to a great financial gamble: You've been hoodwinked to believe that wealth can be created by recklessly trusting in the uncontrollable and unpredictable markets: the housing market, the stock market, and the job market. This impotent financial gamble dubiously promises wealth in a wheelchair -- sacrifice your adult life for a financial plan that reaps dividends in the twilight of life. Accept the Slowlane as your blueprint for wealth and your financial future will blow carelessly asunder on a sailboat of HOPE: HOPE you can find a job and keep it, HOPE the stock market doesn't tank, HOPE the economy rebounds, HOPE, HOPE, and HOPE. Do you really want HOPE to be the centerpiece for your family's financial plan?Drive the Slowlane road and you will find your life deteriorate into a miserable exhibition about what you cannot do, versus what you can. For those who don't want a lifetime subscription to "settle-for-less" and a slight chance of elderly riches, there is an alternative; an expressway to extraordinary wealth that can burn a trail to financial independence faster than any road out there.Why jobs, 401(k)s, mutual funds, and 40-years of mindless frugality will never make you rich young. Why most entrepreneurs fail and how to immediately put the odds in your favor. The real law of wealth: Leverage this and wealth has no choice but to be magnetized to you.The leading cause of poorness: Change this and you change everything.How the rich really get rich - and no, it has nothing to do with a paycheck or a 401K match.Why the guru's grand deity - compound interest - is an impotent wealth accelerator.Why the guru myth of "do what you love" will most likely keep you poor, not rich. And 250+ more poverty busting distinctions...Demand the Fastlane, an alternative road-to-wealth; one that actually ignites dreams and creates millionaires young, not old. Change lanes and find your explosive wealth accelerator. Hit the Fastlane, crack the code to wealth, and find out how to live rich for a lifetime.

See all

The Little Book That Still Beats the Market

In 2005, Joel Greenblatt published a book that is already considered one of the classics of finance literature. In The Little Book that Beats the Market—a New York Times bestseller with 300,000 copies in print—Greenblatt explained how investors can outperform the popular market averages by simply and systematically applying a formula that seeks out good businesses when they are available at bargain prices. Now, with a new Introduction and Afterword for 2010, The Little Book that Still Beats the Market updates and expands upon the research findings from the original book. Included are data and analysis covering the recent financial crisis and model performance through the end of 2009. In a straightforward and accessible style, the book explores the basic principles of successful stock market investing and then reveals the author’s time-tested formula that makes buying above average companies at below average prices automatic. Though the formula has been extensively tested and is a breakthrough in the academic and professional world, Greenblatt explains it using 6th grade math, plain language and humor. He shows how to use his method to beat both the market and professional managers by a wide margin. You’ll also learn why success eludes almost all individual and professional investors, and why the formula will continue to work even after everyone “knows” it. While the formula may be simple, understanding why the formula works is the true key to success for investors. The book will take readers on a step-by-step journey so that they can learn the principles of value investing in a way that will provide them with a long term strategy that they can understand and stick with through both good and bad periods for the stock market. As the Wall Street Journal stated about the original edition, “Mr. Greenblatt…says his goal was to provide advice that, while sophisticated, could be understood and followed by his five children, ages 6 to 15. They are in luck. His ‘Little Book’ is one of the best, clearest guides to value investing out there.”

See all

The Intelligent Investor, Rev. Ed

The greatest investment advisor of the twentieth century, Benjamin Graham taught and inspired people worldwide. Graham's philosophy of “value investing”—which shields investors from substantial error and teaches them to develop long-term strategies—has made The Intelligent Investor the stock market bible ever since its original publication in 1949.Over the years, market developments have proven the wisdom of Graham’s strategies. While preserving the integrity of Graham’s original text, this revised edition includes updated commentary by noted financial journalist Jason Zweig, whose perspective incorporates the realities of today’s market, draws parallels between Graham’s examples and today’s financial headlines, and gives readers a more thorough understanding of how to apply Graham’s principles.Vital and indispensable, The Intelligent Investor is the most important book you will ever read on how to reach your financial goals.

See all

The One-Page Financial Plan

A simple, effective way to transform your finances and your life from leading financial advisor and New York Times columnist Carl RichardsCreating a financial plan can seem overwhelming, but the best plans aren't long or complicated. A great plan has nothing to do with the details of how to save and invest your money and everything to do with why you're doing it in the first place. Knowing what's important to you, you will be able to make better decisions in any market conditions.The One-Page Financial Plan will help you identify your values and goals. Carl Richard's simple steps will show you how to prioritize what you really want in life and figure out how to get there.'In a world where financial advice is (often purposely) complicated and filled with jargon, Carl Richards distils what matters most into something that is easy and fun to read' Wall Street Journal'Feeling tormented by your finances? Read this book. Now. The One-Page Financial Plan helps you identify what you truly want from life, get crystal clear about the financial position you are starting from today, and develop a simple, actionable plan to narrow the gap between the two' Manisha Thakor, CEO at MoneyZen Wealth ManagementCarl Richards is a certified financial planner and a columnist for the New York Times, where his weekly Sketch Guy column has run every Monday for over five years. He is also a columnist for Morningstar magazine and a contributor to Yahoo Finance. His first book, The Behavior Gap, was very well received, and his weekly newsletter has readers around the world. Richards is a popular keynote speaker and is the director of investor education for the BAM ALLIANCE.

See all

The Barefoot Investor

** Reviewed and updated for the 2020-2021 financial year** This is the only money guide you'll ever need That's a bold claim, given there are already thousands of finance books on the shelves. So what makes this one different? Well, you won't be overwhelmed with a bunch of 'tips' … or a strict budget (that you won't follow). You'll get a step-by-step formula: open this account, then do this; call this person, and say this; invest money here, and not there. All with a glass of wine in your hand. This book will show you how to create an entire financial plan that is so simple you can sketch it on the back of a serviette … and you'll be able to manage your money in 10 minutes a week. You'll also get the skinny on: Saving up a six-figure house deposit in 20 months Doubling your income using the 'Trapeze Strategy' Saving $78,173 on your mortgage and wiping out 7 years of payments Finding a financial advisor who won't rip you off Handing your kids (or grandkids) a $140,000 cheque on their 21st birthday Why you don't need $1 million to retire … with the 'Donald Bradman Retirement Strategy' Sound too good to be true? It's not. This book is full of stories from everyday Aussies — single people, young families, empty nesters, retirees — who have applied the simple steps in this book and achieved amazing, life-changing results. And you're next.

See all

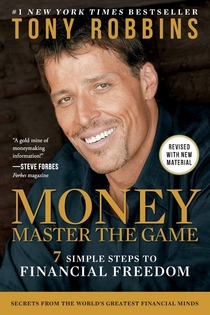

MONEY Master the Game

Tony Robbins turns to the topic that vexes us all: How to secure financial freedom for ourselves and for our families. “If there were a Pulitzer Prize for investment books, this one would win, hands down” (Forbes).Tony Robbins is one of the most revered writers and thinkers of our time. People from all over the world—from the disadvantaged to the well-heeled, from twenty-somethings to retirees—credit him for giving them the inspiration and the tools for transforming their lives. From diet and fitness, to business and leadership, to relationships and self-respect, Tony Robbins’s books have changed people in profound and lasting ways. Now, for the first time, he has assembled an invaluable “distillation of just about every good personal finance idea of the last forty years” (The New York Times). Based on extensive research and interviews with some of the most legendary investors at work today (John Bogle, Warren Buffett, Paul Tudor Jones, Ray Dalio, Carl Icahn, and many others), Tony Robbins has created a 7-step blueprint for securing financial freedom. With advice about taking control of your financial decisions, to setting up a savings and investing plan, to destroying myths about what it takes to save and invest, to setting up a “lifetime income plan,” the book brims with advice and practices for making the financial game not only winnable—but providing financial freedom for the rest of your life. “Put MONEY on your short list of new books to read…It’s that good” (Marketwatch.com).

See all

Rich Dad, Poor Dad

In Rich Dad Poor Dad, the #1 Personal Finance book of all time, Robert Kiyosaki shares the story of his two dad: his real father, whom he calls his poor dad,’ and the father of his best friend, the man who became his mentor and his rich dad.’ One man was well educated and an employee all his life, the other’s education was street smarts” over traditional classroom education and he took the path of entrepreneurship a road that led him to become one of the wealthiest men in Hawaii. Robert’s poor dad struggled financially all his life, and these two dads these very different points of view of money, investing, and employment shaped Robert’s thinking about money. Robert has challenged and changed the way tens of millions of people, around the world, think about money and investing and he has become a global advocate for financial education and the path to financial freedom. Rich Dad Poor Dad (and the Rich Dad series it spawned) has sold over 36 million copies in English and translated editions around the world. Rich Dad Poor Dad will explode the myth that you need to earn a high income to become rich challenge the belief that your house is an asset show parents why they can’t rely on the school system to teach their kids about money define, once and for all, an asset and a liability explain the difference between good debt and bad debt teach you to see the world of money from different perspectives discuss the shift in mindset that can put you on the road to financial freedom

See all

Comments