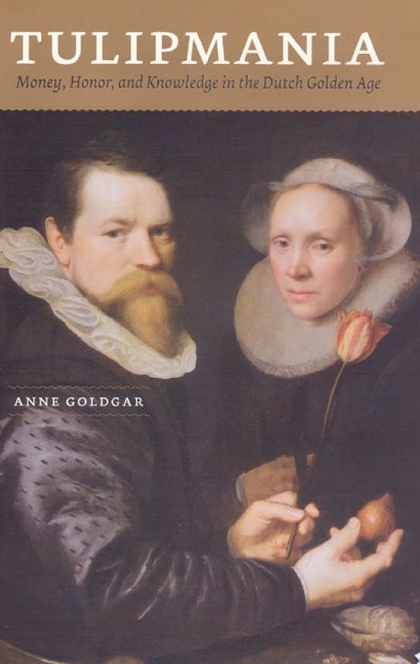

Tulipmania

Updated:

7 Sep 2020

In the 1630s the Netherlands was gripped by tulipmania: a speculative fever unprecedented in scale and, as popular history would have it, folly. We all know the outline of the story—how otherwise sensible merchants, nobles, and artisans spent all they had (and much that they didn’t) on tulip bulbs. We have heard how these bulbs changed hands hundreds of times in a single day, and how some bulbs, sold and resold for thousands of guilders, never even existed. Tulipmania is seen as an example of the gullibility of crowds and the dangers of financial speculation. But it wasn’t like that. As Anne Goldgar reveals in Tulipmania, not one of these stories is true. Making use of extensive archival research, she lays waste to the legends, revealing that while the 1630s did see a speculative bubble in tulip prices, neither the height of the bubble nor its bursting were anywhere near as dramatic as we tend to think. By clearing away the accumulated myths, Goldgar is able to show us instead the far more interesting reality: the ways in which tulipmania reflected deep anxieties about the transformation of Dutch society in the Golden Age. “Goldgar tells us at the start of her excellent debunking book: ‘Most of what we have heard of [tulipmania] is not true.’. . . She tells a new story.”—Simon Kuper, Financial Times